Published: 11 November 2024 2:19 pm Author: Oliver Stanley

Supporting clients with their option management & maintenance – a case study

Professional advisers have often been reluctant to get involved with managing their client’s option schemes and grants. They are happy (and very well suited) to advise on creating the schemes and implementing the grants. However, tracking vesting, keeping copies of relevant documents, dealing with option holder queries etc. have all been seen as outside of their responsibility, too time consuming or too expensive.

Kudocs is primarily a company register system. This includes shareholder registers which are the core basis of any cap table. Kudocs includes a cap table builder which is partially driven by the contents of the shareholder register. To be really useful any cap table also has to include details of ‘un-issued’ equity to provide the fully-diluted position. Kudocs has the ability to include this information as well – whether options, warrants or loan notes.

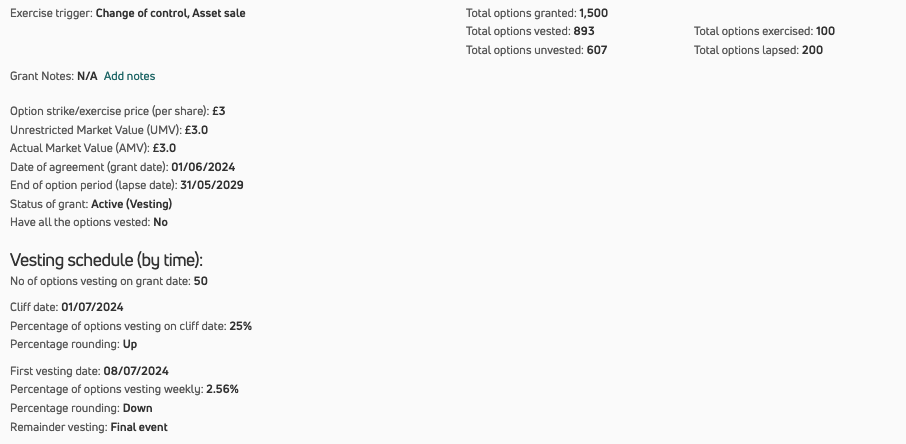

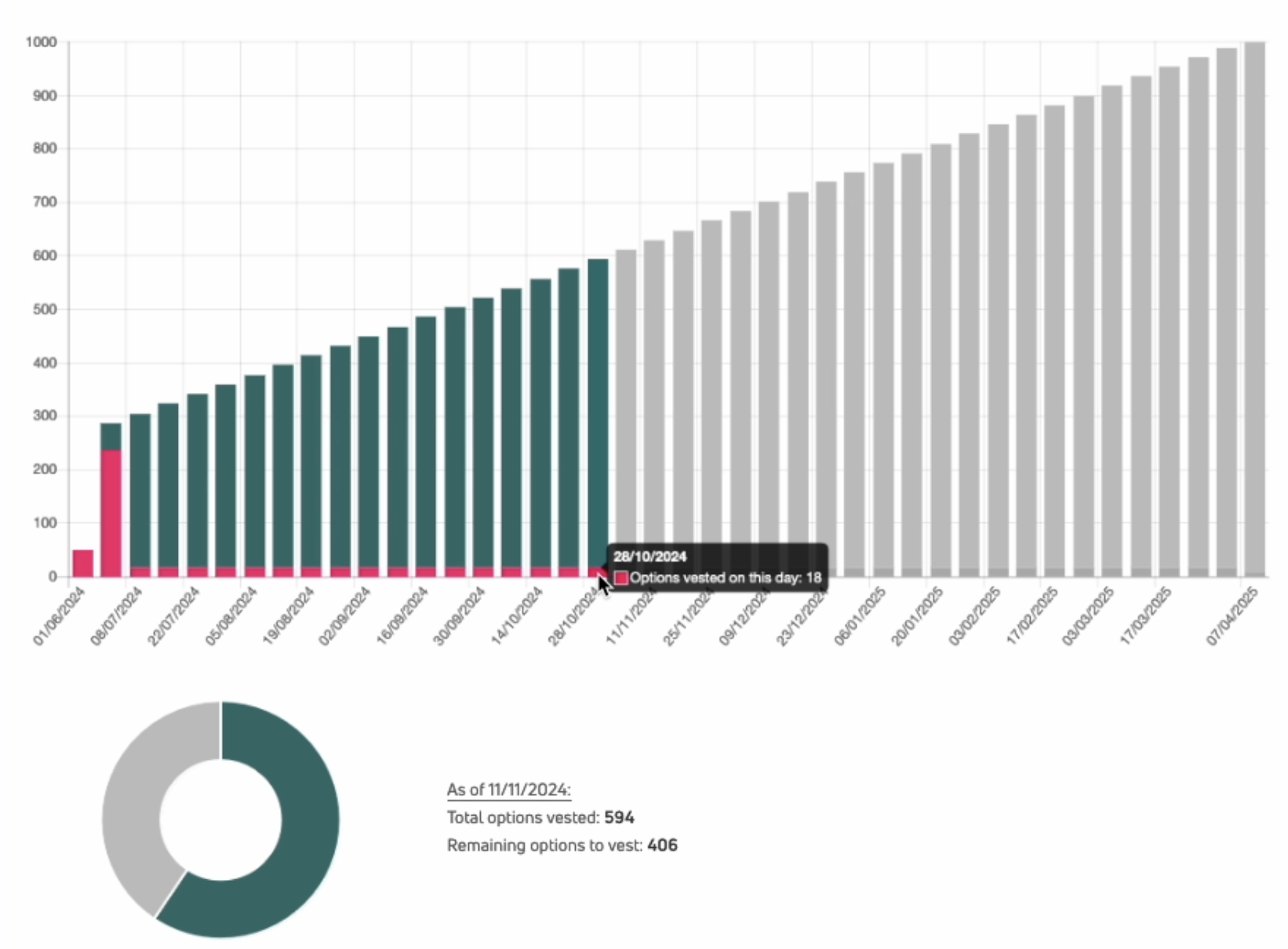

A lot of our direct customers – i.e. companies who used Kudocs directly, without the use of a professional adviser – are using the option management features in Kudocs. They use Kudocs to record details of option schemes and grants, and track and manage option holder information (including vesting, lapse, exercise, option holder departure, etc).

And now an increasing number of our adviser customers are using the same option features to support their clients. Using Kudocs to handle the admin means that they can provide a valuable advisory service to their clients at an affordable cost, without tying up large amounts of fee-earner time on the more mundane elements of option management (such as tracking vesting). As well as being an additional service that they can offer their clients which creates a new revenue stream and extra contact point with the client, professional advisors are the right people to be doing this work for clients – as it is easy to get it wrong and the cost of resolving errors is much higher than the cost of getting it right in the first place.

One customer in particular was being asked by a significant number of their clients for help with managing their option schemes. The law firm in question could not offer this service at the right price and for the right amount of internal cost & effort. They raised this in a call with us and we were able to showcase our options tool which answered almost all of their needs. They had some enhancements and suggestions which we implemented and they – and all of our customers – now have access to a very powerful and useful option management tool.

Our customer is responsible for most of the administration of the option scheme, but they share some of that load with their client. Their client, in turn, provides access to the option holder dashboard to improve stakeholder relations, and reduce the administrative burden on the client and the law firm – as the option holders can use the dashboard to self serve, rather than keep asking for information.